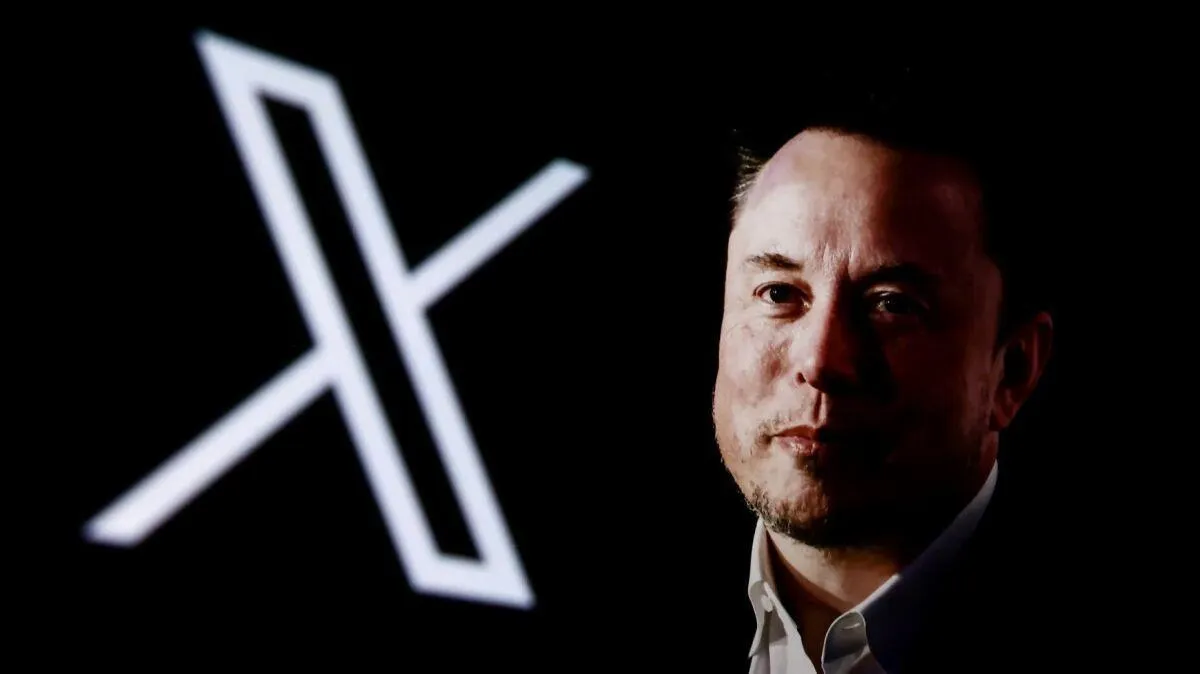

Elon Musk Hit with SEC Lawsuit Over Shocking Twitter Scandal!

The U.S. Securities and Exchange Commission (SEC) has filed a lawsuit against Elon Musk, accusing him of delaying the disclosure of his stake in Twitter (now X) in 2022.

SEC Claims Musk Violated Federal Securities Laws

In a lawsuit filed on January 14 in a Washington, D.C. federal court, the SEC alleges that Musk waited 11 days to disclose his initial 5% stake in Twitter, violating federal securities laws. According to SEC regulations, investors must disclose their holdings within 10 days of reaching the 5% threshold.

By failing to report his stake on time, the lawsuit claims that Musk was able to continue purchasing Twitter shares at a lower price. By the time he made his disclosure, he had acquired 9.2% of Twitter’s shares, and after the announcement, Twitter’s stock price jumped 27%.

SEC Seeks Financial Penalties

The SEC is demanding that Musk pay a civil penalty and return any unlawful profits gained from the delay. The case is part of a broader regulatory effort to ensure transparency in financial markets and prevent market manipulation.

Musk eventually purchased Twitter for $44 billion in October 2022 and later rebranded the platform as X.

Musk’s Legal Team Calls It “Harassment”

Alex Spiro, Musk’s attorney, strongly criticized the lawsuit, calling it the result of a “year-long harassment campaign” by the SEC. Spiro insists that Musk did nothing wrong and that the SEC is unfairly targeting him.

Musk’s Ongoing Feud with the SEC

This latest legal battle is just one of many clashes between Musk and the SEC over the years.

One of the most infamous incidents occurred in 2018, when Musk tweeted that he had secured funding to take Tesla private at $420 per share. The SEC ruled that the statement was misleading and fined him $20 million. As part of the settlement, Musk was forced to step down as Tesla’s chairman and agree to have Tesla lawyers review any future social media posts related to the company.

Musk Faces Additional Lawsuits Over Twitter Deal

This is not the only lawsuit related to Musk’s handling of his Twitter acquisition. In Manhattan federal court, a group of Twitter shareholders has also sued Musk, claiming that his delayed disclosure of stock purchases misled investors and manipulated the stock price to his advantage.

Musk’s Expanding Business Empire

Despite his legal troubles, Elon Musk remains the world’s richest person, with a net worth of $417 billion, according to Forbes.

He is currently the CEO or key figure in multiple high-profile companies, including:

– Tesla – Leading electric vehicle manufacturer

– SpaceX – Aerospace and space exploration company

– X (formerly Twitter) – Social media platform

– xAI – Artificial intelligence startup

What’s Next for Musk?

While Musk is no stranger to legal battles, this lawsuit could result in significant financial penalties if the SEC prevails. However, given his history of fighting regulatory actions and pushing legal boundaries, it is likely that he will challenge the SEC’s claims aggressively.

This case underscores the ongoing tension between regulators and high-profile tech billionaires, raising broader questions about how financial rules should be enforced in the rapidly evolving tech and investment landscape.

Post Comment